Succession Planning in Private Equity: A Strategic Imperative for GPs and LPs

Private equity (PE) has expanded to an unprecedented scale, with industry assets under management exceeding $15.5 trillion and global buyout firms holding $1.2 trillion in dry powder.[1] Yet despite this growth, complexity, and institutional scrutiny, leadership models have remained largely unchanged, and general partner (GP) turnover remains exceptionally low.

Academic research indicates that only around 6% of GP leaders transition over a five-year period, vs. turnover rates above 50% over comparable horizons for public company CEOs.[2] What was once viewed as a marker of stability is increasingly revealing a different risk: the concentration of authority, economics, and client relationships in a small number of people, amplifying key-person risk.

As firms manage overlapping fund vintages, longer holding periods, and increasingly complex portfolios, the absence of clear transition planning has become a material governance issue. Recent surveys indicate that succession readiness and governance maturity are now decisive factors in re-up decisions for 96% of limited partners (LPs), yet fewer than half of GPs have established a formal transition plan.[3] In an environment defined by more selective capital, heightened diligence and a tougher fundraising market, this gap between capital at risk and organizational preparedness is no longer sustainable.

For LPs, the question is not whether succession matters, but how to distinguish genuinely institutionalized platforms from firms where continuity risk remains underappreciated or obscured. For GPs, the challenge is how to reshape leadership models, economics and governance without destabilizing performance or culture.

This paper examines why succession efforts fail in some firms and succeed in others, highlighting effective approaches adopted by durable franchises and offering practical guidance for investors and managers navigating one of the most consequential leadership issues facing private equity.

PE leadership transition preparation no longer is driven by isolated founder retirements or episodic key-person events; it is being forced by structural shifts in the industry’s scale, demographics, ownership and investor expectations. These include:

1. Scale is magnifying leadership risk

The U.S. PE market has grown by over 50% in the past decade to over 11,500 firms, yet decision-making authority often remains concentrated among a small group of senior partners.[4] Even gradual founder disengagement can disrupt portfolio decision-making, deployment and fundraising momentum.

2. Demographic forces are prompting founder transitions

Many first-generation PE founders are approaching retirement, particularly those who started firms in the 1980s and ’90s. Firms that have never undergone senior leadership transitions or lack codified governance face much higher operational and strategic risks when executing their first succession.

3. GP stakes investors are elevating scrutiny

Such investors, or those that take stakes in PE firms—such as Blue Owl Capital, Blackstone, Petershill Partners and others—are directly underwriting long-term leadership continuity, as their returns depend on the durability of management fees and future carried interest. Thus, succession readiness has become a core investment criterion. These investors expect clearly defined decision rights, aligned economics, structured leadership pipelines and formal transition road maps.

4. LP expectations are evolving

They increasingly apply the same rigor as GP stakes investors when assessing management durability. They expect documented succession plans, transparent governance and decision-making frameworks, and evidence that emerging leaders have genuine authority and economic influence. Firms without credible succession plans may face deeper diligence, more restrictive terms, or reduced allocations.

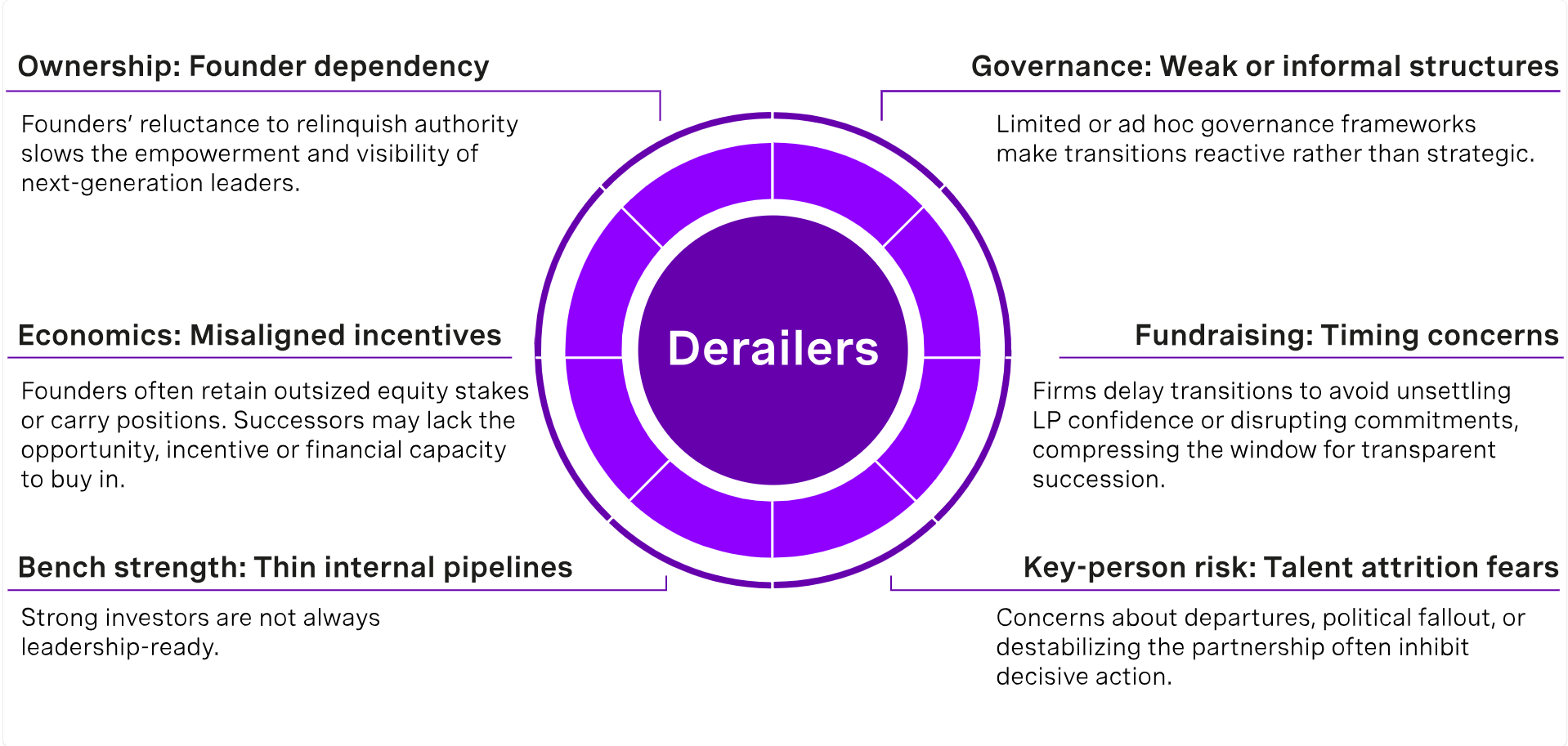

PE leadership transitions involve far more than title changes. They require navigating structural, economic, and human capital constraints that make orderly succession complex and challenging to execute.

Research and case studies show that the most successful firms actively plan succession, often starting years ahead of the need. The four key best-practice themes:

1. Start early and build credibility before a transition

Top PE firms identify future leaders well before a change is imminent, often at least one full fund ahead. They assign potential successors visible operational and leadership responsibilities, such as leading an investment sector, recruiting talent, building teams and contributing to fundraising. In these models, authority comes before the title.

2. Realign economics gradually

Transitioning leadership often requires a gradual shift in equity stakes and carry allocations. Leading firms reallocate economics across fund vintages and, in some cases, create fund-specific management entities that allow newer partners to incrementally buy in. Sunset provisions enable founders to step back and relinquish preferential returns without triggering a cliff-edge drop in value. In this context, GP stakes investors play a critical role by providing the liquidity and capital for these economic transfers.

3. Institutionalize governance

Succession is not a backroom deal for best-in-class GPs. They formalize decision rights, add independent chairs or advisers and run disciplined partner and talent reviews, which reduces politics and surfaces issues early. Embedding succession in governance rather than reacting in crisis signals stability to LPs.

4. Communicate transparently with LPs

LPs do not expect succession risk to disappear; they expect clarity and consistency. Top GPs provide regular updates on leadership development, including who is leading deals, who will oversee portfolio sectors and how economics will vest for new partners. Firms that communicate progress experience fewer fundraising disruptions when transitions occur. Conversely, surprises or limited transparency around succession often unsettle investors and erode confidence.

Investors increasingly look for a structured way to evaluate continuity risk within GP organizations. We offer a simple, practical framework for assessing a firm’s succession readiness and identifying the level of oversight or intervention required. It categorizes risk into three tiers and highlights the governance, economic and leadership indicators that most directly influence long-term durability.

Guidance by risk tier:

- Low Risk: Maintain standard reporting with no additional intervention.

- Medium Risk: Increase engagement, request periodic governance updates and monitor progress on economic alignment.

- High Risk: Consider conditional allocations, co-investment restrictions, involvement of GP stakes investors, or enhanced oversight of investment committee processes.

| Dimension | Low Risk | Medium Risk | High Risk |

| Governance | A well-institutionalized governance model featuring clear allocation of decision authority and consistently applied independent oversight. | Governance structures exist but are inconsistently applied or untested under stress; decision rights may blur in complex situations, and independent oversight is limited. | Governance is informal and heavily founder-dependent; investment committee structures lack transparency, and decision-making authority is concentrated in people rather than processes. |

| Economics | Founder(s) contribution respected through a structured, staged ownership transition; successors are economically empowered with transparent pathways and aligned incentives. | Economic realignment is underway but incomplete; successors have some visibility into ownership pathways, but incentives may not yet be fully calibrated to long-term leadership transition. | Economics remain concentrated with founders; limited or ambiguous ownership pathways create uncertainty for successors and undermine long-term leadership stability. |

| Authority Transfer | Authority is deliberately shifted ahead of title changes; successors lead core strategies, hold meaningful investment committee responsibilities and manage key LP relationships. | Authority is visible internally, with successors having increased responsibility and voice, but it is not yet fully recognized by LPs; founders still intervene in key decisions at moments of uncertainty. | Titles may change, but effective control remains with founders; successors have limited autonomy, restricted investment committee roles, and insufficient exposure to LPs or external stakeholders. |

| Investor Assessment | High confidence in continuity and leadership depth; transition unlikely to disrupt performance, fundraising or future allocation decisions. | Risk is manageable with periodic monitoring and active engagement; investors may request evidence of progress but do not yet view transition dynamics as performance-threatening. | Elevated key-person and continuity risk; transition concerns may influence allocation decisions, pacing or re-ups and may require heightened due diligence or conditional commitments. |

These can guide investors in assessing whether a firm is prepared for a sustainable, smooth leadership transition that protects continuity and performance:

1. Who makes investment decisions?

Titles carry limited weight. LPs should look for evidence of real authority within investment committees and portfolio decisions.

2. Who owns the LP relationship, and can it be transferred?

Continuity risk is higher when trust rests primarily with people rather than teams or institutions.

3. What happens economically if a founder/managing partner steps back?

Investors should scrutinize whether economic changes have already been made or whether successors remain subordinate.

4. Has the successor been tested at scale?

LPs should look for evidence that emerging leaders have successfully executed the firm’s strategy, demonstrated strong investment judgment, and delivered results across markets and portfolio contexts.

5. Is governance strong enough to manage conflict after a transition?

Independent oversight, clear decision rights, and formal evaluation processes reduce the risk of internal conflict post-transition.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.